Single family homes, multi-unit complexes, residential estates, commercial buildings, rental multiplexes – to become good investment properties, they all have one common need: Good property management. Ignoring this basic tenant of wealth creation and management leads to longer-term wealth erosion. But for Baltimore-area property owners, not working with a competent Baltimore county property management service provider can even have near term income-generation impact.

Let’s understand what we’re talking about.

Real versus Perceived Value

Whether you own rental property, or whether you’ve purpose-built a commercial complex from where you operate your business – that property likely represents an important component of your wealth. In both cases, it’s easy to perceive the value of that investment as being greater (or less!) than what it truly is.

For example, experienced Baltimore property management companies ensure their client-owned rental properties have minimal – preferably zero! – vacancy rates. This means that as soon as a tenant moves out, they’ve lined up another to move in. This near-seamless move in/out of rental units ensures a continuous, unbroken flow of rental income to the property owner. Professional real estate managers have resources, networks and industry channels and connections to guarantee such value.

But what if property owners, who lack property management experience, decided to play landlord, real estate agent and property manager? Worse still, what if a less-experienced property manager oversees your property in an otherwise “hot” Baltimore neighborhood. What might be the value implications?

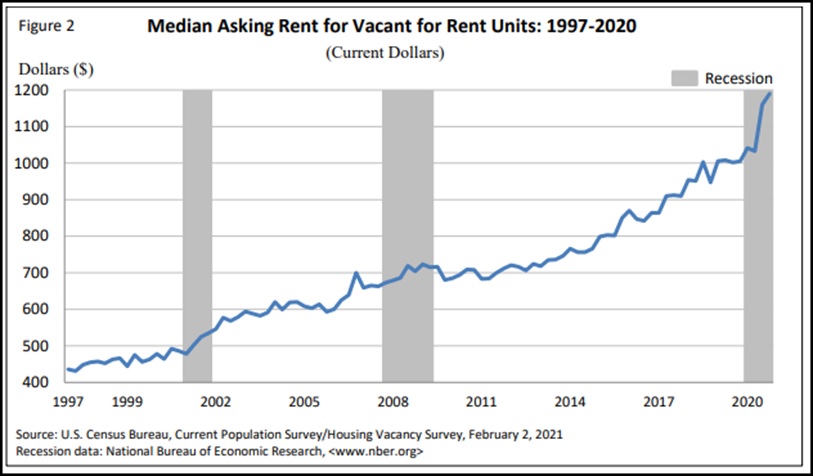

Looking at the numbers published by the U.S. Census Bureau, it’s easy to answer those “What if?” questions with a simple comment: Things would be bad for property owners, especially those that depend on rental income!

Real Value by The Numbers

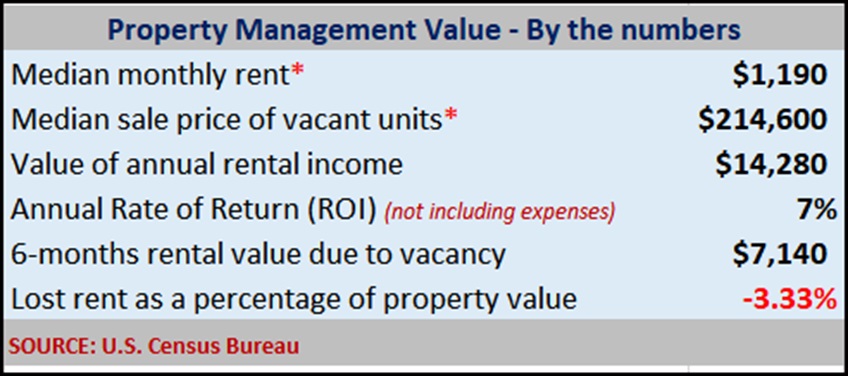

Let’s put these assumptions into perspective. According to Q4-2020 statistics from the U.S. Census Bureau:

- the median asking rent for vacant rental units in Q4-2020 was $1,190

- the median asking price for a for-sale unit was $214,600

Clearly, if you don’t have the experience or temperament of a great property manager, or if your property isn’t under the management of an exceptional Baltimore county property management company, you’re unlikely to see the smooth flow of rental tenants into your vacant properties. That’s because it takes connections, networks, industry savvy and plenty of property management experience to deliver those results.

So, what kind of value erosion might inexperience or ineptitude deliver?

Well, based on Census Bureau data, through their efforts and knowledge, an experienced property manager could potentially deliver you an annual return on investment (ROI) approaching 7%. However, not having your rental units occupied – even for half a year – could result in a 3.33% erosion in property income annually.

So, could property owners have received better value for money with non-real estate investments? The answer: A resounding NO! Looking at the year-to-date returns of popular investment alternatives, including the Dow Jones (DIA), S&P 500 and 7 to 10-year Treasuries, the 4.43%, 3.55% and -4.41% returns respectively just don’t compare to what professional property managers promise.

Bottomline

Working with professional Baltimore property management companies can deliver property management value beyond just the convenience they offer asset owners and landlords. Along with the peace of mind that comes from professionals managing your property, you also receive certainty of your short-term income generation goals, as well as longer-term asset value appreciation.